So you have been hearing a lot of whoosh well-nigh Star Health IPO and want the full scoop on their share price, huh? You come to the right place. We will requite you the well-constructed lowdown on Star Health stock performance so you can decide whether it is a suitable investment for you. We walk you through Star Health’s merchantry model, financials, growth plans, and risks. By this end, you know the Star Health share price inside and out. Strap in, folks. It is going to be a wild ride.

Table of Contents

Star Health Share Price History and Performance

Star Health’s share price has seen significant growth since its IPO in 2021. It is poised for major success as India’s largest private health insurer.

Star Health’s share price has seen significant growth since its IPO in 2021. It is poised for major success as India’s largest private health insurer.

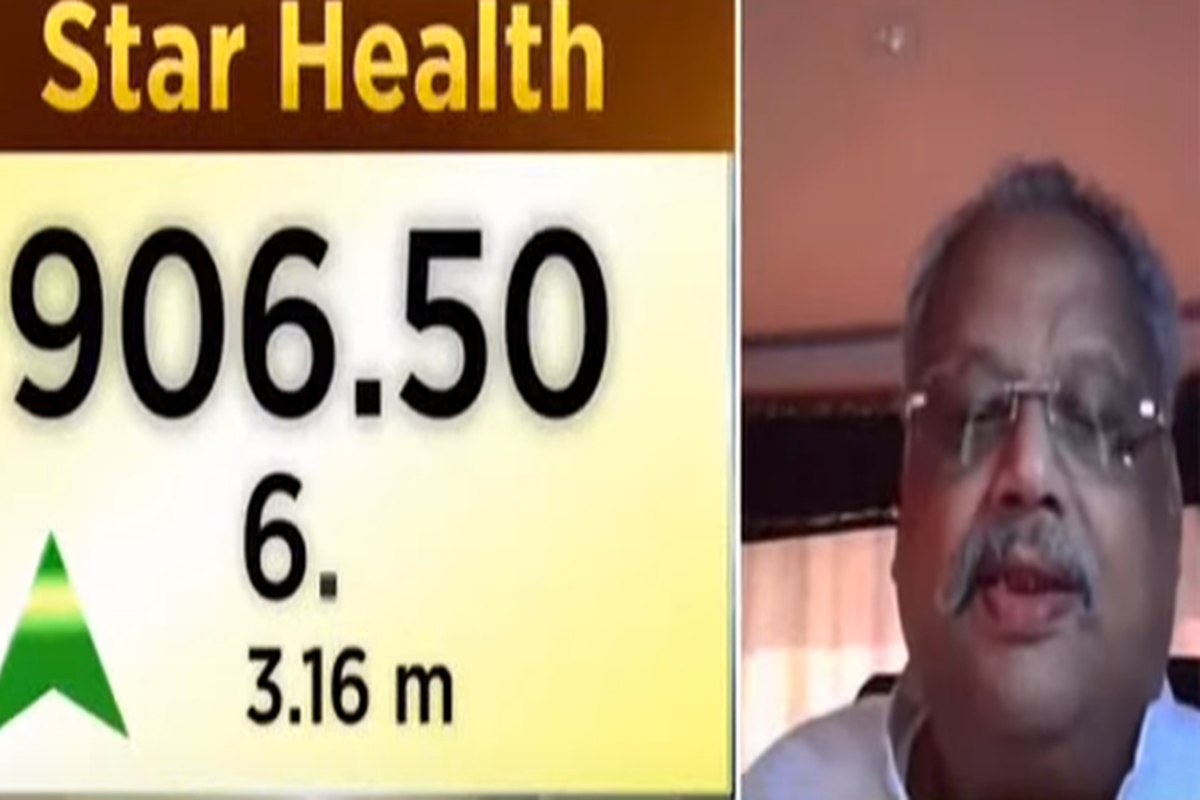

- Star Health’s IPO issue price was 900 in December 2021. The share price closed over 60% higher at 1468 on the listing day. Talk about a strong debut! Since then, the stock has climbed over 100 to around 1570 currently.

- Star Health’s strong performance is thanks to India’s booming health insurance market. As incomes rise, more Indians want private health coverage. Star Health leads the way with over 15 million customers so far.

- Star Health also benefits from a young, tech-savvy customer base. Over 70% of customers buy policies digitally, so Star Health invests heavily in IT and digital services. This online convenience and service attract many first-time insurance buyers.

- However, Star Health’s share price faces risks too. New competitors could emerge, and government policy changes might impact the health sector. Claims costs could also rise substantially. Investors should monitor how Star Health navigates these challenges.

Key Factors That Influence the Star Health Share Price

Regarding the Star Health share price, several key factors are at play.

- Financial Performance. How well is the company doing? Profits, revenue growth, and new policies issued all significantly impact the stock price. Investors will likely bid the shares up if Star Health reports strong quarterly results and raises guidance. On the other hand, if financials disappoint and the outlook is lowered, the shares will probably drop.

- Economic Environment. A strong, growing Indian economy with low inflation and interest rates, including Star Health, suits most stocks. It often leads to fewer new insurance policies being purchased, hurting Star Health’s profits and share price.

- Government Regulations. New laws or policies from IRDAI, India’s insurance regulator, can significantly impact Star Health. Changes to product guidelines, foreign investment rules, or licensing requirements may help or hurt Star Health’s business model and share price. Investors continually monitor the regulatory landscape closely. The opposite is also true. Investor sentiment can quickly shift, so this factor often introduces volatility.

Star Health Business Overview and Revenue Model

Their revenue model is based primarily on the premiums customers collect for the insurance policies they sell.

Investment Income

Star Health moreover earns income from investing the premium amounts placid surpassing claims are paid. They invest primarily in government securities, stock-still deposits, bilateral funds, and probity shares.

Strong Financials

Star Health has a solid balance sheet with reasonable debt levels and consistent annual revenue growth of over 20%. As the company gains more customers and increases premiums, revenue, and profits are projected to rise substantially. This operational leverage could drive Star Health’s share price notably higher, significantly if it can boost its profit margins over time.

While risks like new competitors, medical inflation, and natural disasters exist, Star Health has built a sustainable competitive advantage in health insurance. Overall, the future is bright for this market leader, and long-term investors in Star Health stock may be well rewarded. Staying invested in the stock could result in good returns over the next 3 to 5 years, if not longer. The company seems poised to thrive, and Star Health’s share price appears positioned for solid gains.

Conclusion

So there you have it: a deep swoop into Star Health’s share price and the future. While the past year has been rocky, the long-term growth story remains intact. Healthcare is a sector that will protract to expand in a country like India, with increasing wealth and life expectancy. Star Health is poised to goody as increasingly people proceeds wangle to private insurance. Star Health deserves a spot in your portfolio if you believe in the India growth story and see healthcare as a crucial part of that. Watch for the IPO and consider investing for the long haul.